Crypto tried to make payments work since Bitcoin launched.

Most say it failed.

But did it?

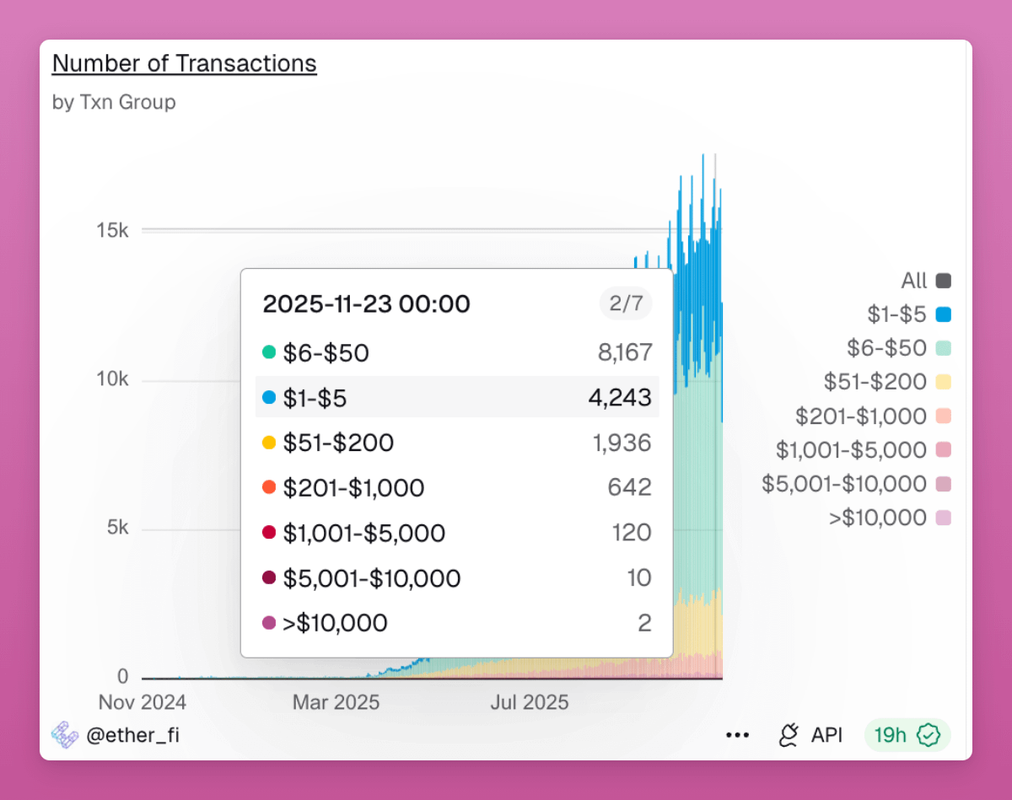

Look at EtherFi Card data: most transactions are small payments of $1 to $50 USD.

Sure, it's not the P2P crypto payments we wanted to have: Visa or Mastercard is the intermediary. We need KYC.

But onchain it looks the same.

Every coffee you buy settles on ETH L2s, Solana etc. with gas paid.

Whether it came from a crypto wallet or a card swipe does not matter for the chain.

And you still get the upside of crypto:

• Self custody with many more options in 2025

• DeFi integration through EtherFi Cash

• No need to cash out stablecoins to a legacy bank

Yes, Visa and Mastercard take a big cut. But it might be a transitory stage.

New non custodial crypto cards are building their own payment rails. Payy is one of them.

First, crypto cards use the reach of Visa and Mastercard.

Then they attract users with stronger rewards: cashbacks, collateral backed credit, and yield that banks cannot touch.

If they grow beyond the crypto niche, these networks can start eating into the legacy payment stack.

That is the hard part.

But the base is here.

People are already spending using blockchain space and bringing stablecoin adoption.

A real start for crypto payments

These payments are a lifeline for crypto wallets:

Argent (now Ready )has been struggling to find PMF but since they added card payments they stats are up only.

EtherFi card directly increases demand for borrowing without the leverage looping that DeFi relies so much.

This increases DeFi resilience from bull/bear cycles.

11.95 k

91

El contenido al que estás accediendo se ofrece por terceros. A menos que se indique lo contrario, OKX no es autor de la información y no reclama ningún derecho de autor sobre los materiales. El contenido solo se proporciona con fines informativos y no representa las opiniones de OKX. No pretende ser un respaldo de ningún tipo y no debe ser considerado como un consejo de inversión o una solicitud para comprar o vender activos digitales. En la medida en que la IA generativa se utiliza para proporcionar resúmenes u otra información, dicho contenido generado por IA puede ser inexacto o incoherente. Lee el artículo enlazado para más detalles e información. OKX no es responsable del contenido alojado en sitios de terceros. Los holdings de activos digitales, incluidos stablecoins y NFT, suponen un alto nivel de riesgo y pueden fluctuar mucho. Debes considerar cuidadosamente si el trading o holding de activos digitales es adecuado para ti según tu situación financiera.