1/ Blockchain adoption has advanced & made strides in recent years.

But few have achieved real-world distribution at a global scale.

That’s why @iota’s new partnership w/ @wef @InstituteGC for ADAPT is a historical for crypto as a whole.

Insights & what it means for $IOTA 🧵

2/ @iota has come a long way since its early IoT-focused origins.

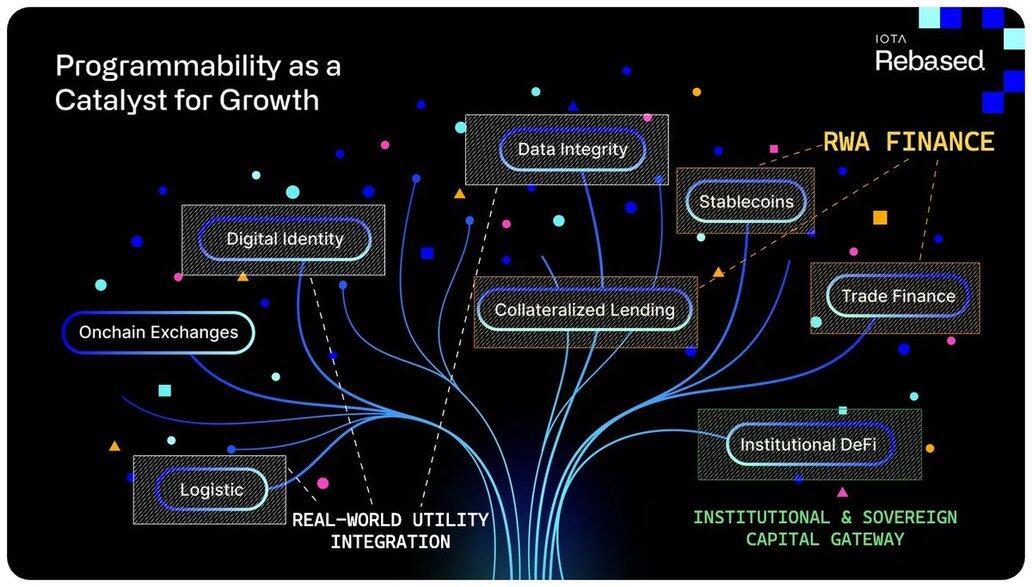

With IOTA Rebased, the network pivoted toward one core mission:

Usability Distribution → real-world use cases that bridge programmability with enterprise-grade requirements across industrial + financial sectors.

This comes with a full-stack composability enables true E2E workflows, positioning IOTA as a turnkey foundation for real-world digital finance at scale.

Robust frameworks → compliance → trust → distribution → actual usage.

3/ Fast-forward to today, @iota is now taking on a continental-level initiative: ADAPT.

The goal?

Advance free trade & cross-border economic activity across 55+ countries by powering a unified digital public infrastructure.

This builds directly on previous strategic involvements, including:

1️⃣ TLIP: integrated with Kenya Revenue Authority, KenTrade, KEPHIS for verifiable trade documents

2️⃣ TWIN: a public digital infrastructure powering global supply chains with real-time trade data exchange

And now, IOTA is stepping up this vision from national deployments to an entire continent → a huge step-up in future economic impact scale.

4/ ADAPT’s digital infrastructure spans three major pillars:

1⃣ Trusted Digital Identity → Decentralised identifiers integrated with national ID systems (Kenya eCitizen, Nigeria NIMC).

2⃣ Cross-Border Data Exchange → Smart contracts + AI-driven compliance + IoT logistics that is fully digitised, authenticated & tamper-proof documentation.

3⃣ Interoperable Finance Layer → Connecting mobile money, banks, stablecoins (USDT), and digital currencies into one seamless network.

This unifies goods, information & payments into a single trusted system, transforming how Africa operates at scale.

5/ This strategic initiative comes with long-term targets stretching all the way to 2035, and the scale is enormous:

🔸 2x annual trade (+$70B)

🔸 Border clearance delays reduced from 14 days → 3 days

🔸 $23.6B in annual gains from faster + more efficient trade

🔸 Cross-border payment fees dropping from 6–9% → ~3%

This is a complete overhaul of how a continent trades with goals that, if achieved, would reset the baseline for global digital commerce.

Ofc, these outcomes require deep multi-year execution + continent-wide coordination which are not things that happens overnight.

6/ To make this vision real, IOTA is committing to a decade-long roadmap:

🔹 Hiring of 40+ specialists across Africa

🔹 Build & scale decentralised trade infrastructure

🔹 Foster next-gen innovators via events, hackathons, university partnerships

🔹 Launch new Africa-specific trade finance solutions

The end goal here is to transition Africa away from legacy, fragmented workflows and into a system powered by digital payments via stablecoin settlement & verifiable data rails.

In other words: replace decades of inefficiency with trust, speed, and transparency.

7/ And if you think ahead of this whole initiative. It represents more than that.

The implications for IOTA’s own distribution + adoption flywheel are massive.

Global-scale partnerships compound:

1⃣ Continental establishment → credibility for large-scale institutional adoption

2⃣ Accreditation moat → attracts more partnerships + public-sector integrations

3⃣ Brand solidification → IOTA becomes the go-to chain for real-world utility

4⃣ Value accrual → increased trust, usage, and long-term ecosystem demand

This creates a self-reinforcing growth loop, where every successful deployment feeds into the next.

And all these elevates network relevance + value distribution for $IOTA to an entirely new level:

More economic usage → More fees fees burned & storage deposits locked → Enhanced deflationary pressure

⇒ Increasing value accrual of $IOTA in the long-term underpinned via a sustainable dynamic via real-world utility.

8/ This is a long-term strategic arc, and it places IOTA in a domain with the largest addressable market blockchain can realistically impact.

Real-world utility spans multi-trillion-dollar verticals (trade, supply chains, identity, logistics etc. and yet there are no globally established blockchain infrastructure providers owning this domain.

IOTA has been quietly building toward this niche for years.

Now, the continental rollout begins, and there’s much more ahead.

10/ Thanks for reading if you'd made it this far!

If you'd found this insightful, feel free to show some support & share👇

lastly, tagging frens & chads who might be interested in this IOTA piece:

@0xRimac

@PhyloIota

@0xBusmin

@kowei1995

@ksatoshi_iota

@_thespacebyte

@RubiksWeb3

@bullish_bunt

@DomSchiener

@TheDeFiKenshin

@ahboyash

@bobthedegen_

@eli5_defi

@YashasEdu

@St1t3h

@kenodnb

@belizardd

@crypto_linn

@cryptorinweb3

@thelearningpill

5.71K

130

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.