REV Monthly Update at the start of Dec 2025

The share of Jito tips has shrunk to below 50% with each passing month having been replaced by priority fees increasing its share to over 50%.

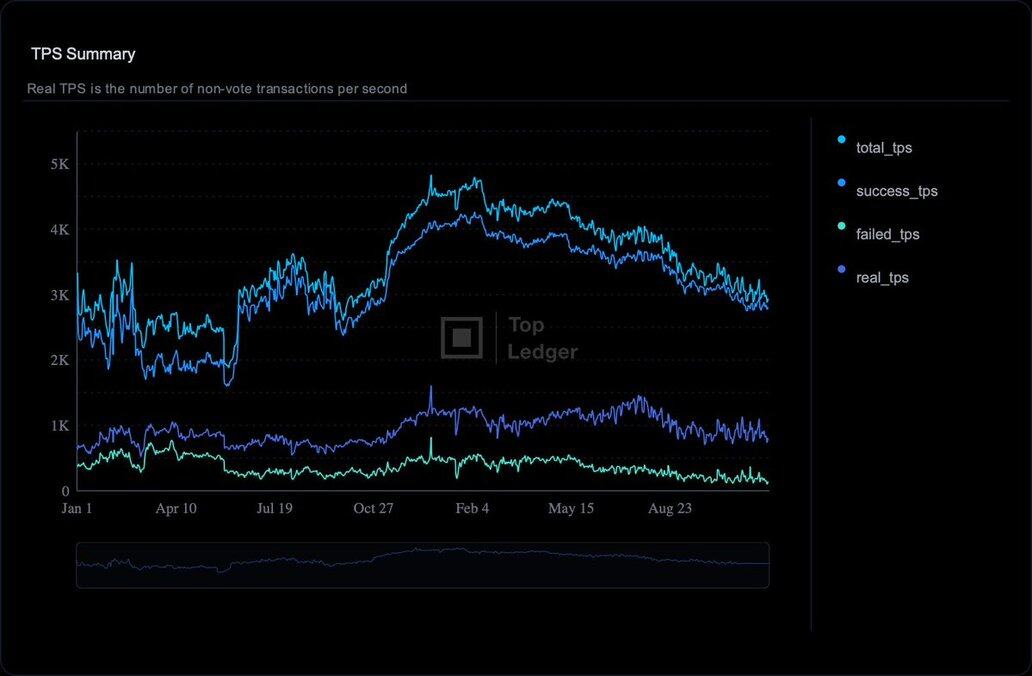

📈 TPS Trends:

The chart highlights a drop in both real TPS (confirmed, user-initiated transactions) and total TPS (all network activity—including vote and maintenance transactions).

This confirms softer user activity, with protocol throughput trending lower even as infrastructure remains robust.

2/n

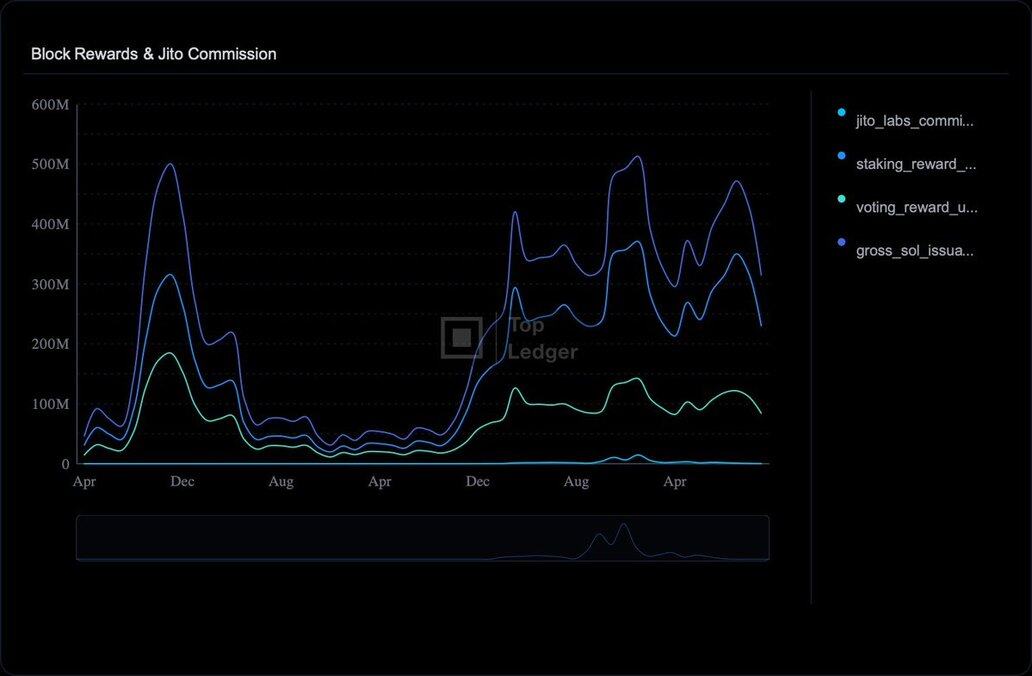

💸 SOL Issuance Watch:

In Nov 2025, gross SOL issuance reached $314.79M with net issuance at $304.94M.

Both metrics are trending lower with rewards to validators reducing after a high-issuance autumn. Watch these spikes—their timing drives supply dynamics and network inflation and thereby prices.

3/n

🔥 SOL Rewards & Burn:

November delivered $230M in staking rewards and $84M in voting rewards, but just $9.85M in SOL burn.

While validator payouts have reduced, burn activity stayed modest—suggesting supply expansion still outweighs the offset from burning.

4/n

🟦 Block Rewards & Jito:

Nov saw $315M in gross SOL issuance, with $230M paid as staking and $84M in voting rewards.

Jito Labs commissions totaled $324k—a small portion indicating that industry is looking at new ways to extract value from the chain like BAM and protocol controlled transaction ordering.

Monitoring these streams helps track validator earnings beyond just inflation.

What next in place ?

5/n

1,196

8

本頁面內容由第三方提供。除非另有說明,OKX 不是所引用文章的作者,也不對此類材料主張任何版權。該內容僅供參考,並不代表 OKX 觀點,不作為任何形式的認可,也不應被視為投資建議或購買或出售數字資產的招攬。在使用生成式人工智能提供摘要或其他信息的情況下,此類人工智能生成的內容可能不準確或不一致。請閱讀鏈接文章,瞭解更多詳情和信息。OKX 不對第三方網站上的內容負責。包含穩定幣、NFTs 等在內的數字資產涉及較高程度的風險,其價值可能會產生較大波動。請根據自身財務狀況,仔細考慮交易或持有數字資產是否適合您。